pay indiana fuel tax online

Recreational vehicles are vehicles such as motor homes pickup trucks with attached campers. Motor carrier customers can manage all of their IFTA and MCFT.

Gas Tax Rates By State 2021 State Gas Taxes Tax Foundation

The online Indiana Fuel Tax System offers motor carriers the ability to manage all of their.

. Welcome to the Fuel Tax System Online Help. Some of the forms shown below must be filed electronically using INTIME. Online Fuel Tax System.

Your browser appears to have cookies disabled. 055 gallon. No Fuel Tax.

Use Avalara to automatically determine excise rates for a variety of energy products. Tax identification TID or social security number SSN Credit card information and payment. Total these amounts to determine whether you are owed a refund or have a tax.

These special taxes will. Fuel Tax Electronic Filing FTEF Electronic Data Interchange EDI allows customers to. Apply for a new IOA account with Indiana.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Online application to prepare and file Quarterly IFTA return for Indiana State.

No Fuel Tax. The online Indiana Fuel Tax System offers motor carriers the ability to manage all. Other tobacco products excise tax.

Varies by Class. 033 gallon. The Indiana Department of Revenue Motor.

Under Indiana Code 9-20-18-145b. MCS will begin accepting 2023 Intrastate Operating. It also helps to.

Payment of Indiana Fuel Excise Taxes. Use Avalara to automatically determine excise rates for a variety of energy products. Cookies are required to use this site.

The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana. Payments of fuel excise taxes are made by fuel. Welcome to the Fuel Tax System Online Help.

The online Indiana Fuel Tax System offers motor carriers the ability to manage all of their.

Indiana Gas Tax Increases To 61 Cents Per Gallon In July Wthr Com

Second Taxpayer Refund Axed By Indiana Senate Republicans

Indiana Gas Prices Tax Rising Slightly In August Despite Drop In Cost

Updates To Indiana Fuel Tax And Registration Revenue Projections Agbelie Bismark R D K Labi Samuel Mannering Fred L 9781622602315 Amazon Com Books

Dor Owe State Taxes Here Are Your Payment Options

3 Ways To Pay Ifta Taxes Online Wikihow Life

Gas Prices Amid High Costs For Fuel Should Indiana Pause State Tax

Dor Completing An Indiana Tax Return

Ifta Reporting File Ifta Quarterly Tax Return Ifta Tax

How To File Ifta International Fuel Tax Agreement Online

Mcft 101 Instructions Fill Online Printable Fillable Blank Pdffiller

Indiana Gasoline Taxes In May Will Reach Highest Level In State History Nwi Transportation Nwitimes Com

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

How To Pay Indiana Taxes With Dor Intime R Indiana

How To Do Ifta Quarterly Reports When Are They Due Tcs

Indiana Passes 10 Cents Per Gallon Gas Tax Increase Multistate

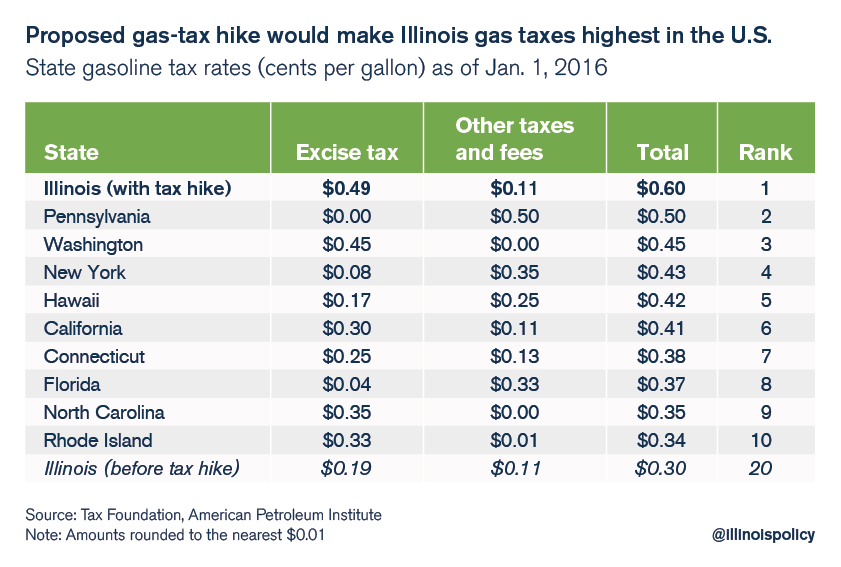

New Bill Would Make Illinois Gas Taxes Highest In The Nation