how to change how much taxes are taken out of paycheck

Adjusting your pre-tax contributions can also affect how much taxes are withheld. Want 10 taken out every time.

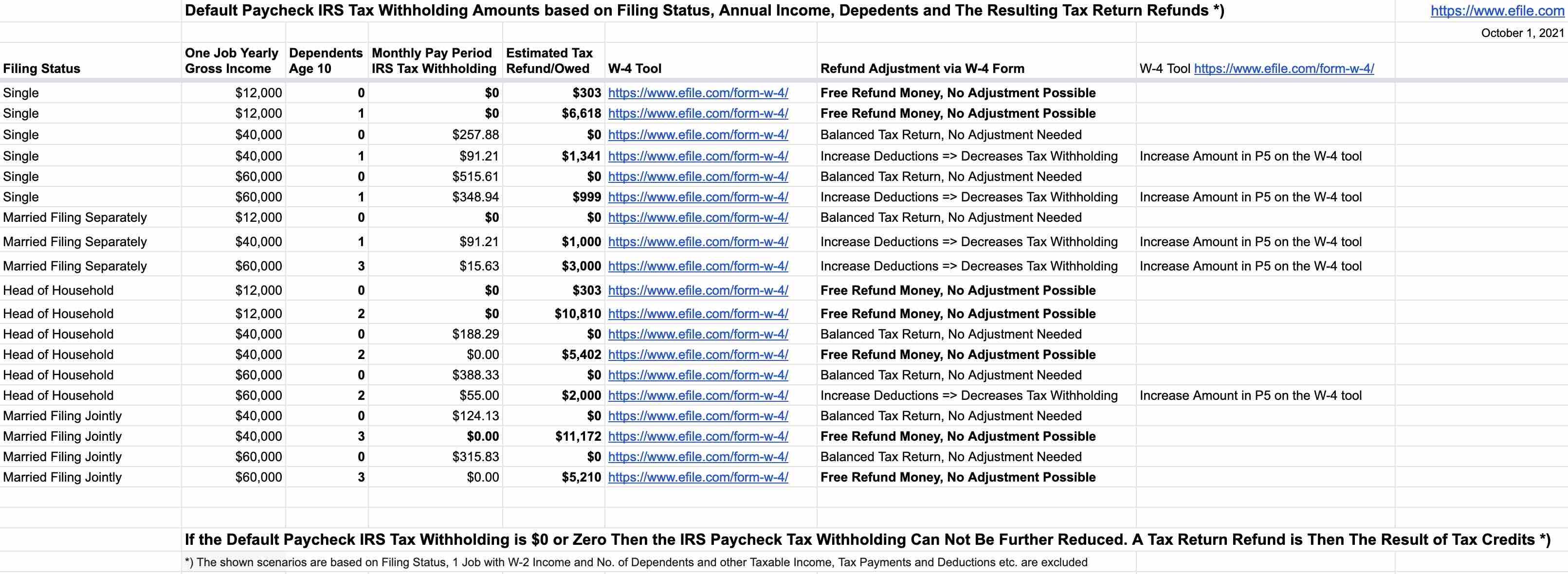

How To Fill Out A W 4 Form Or W4 Tax Withholding 2022

Your taxes may also be impacted if you contribute a portion of your paycheck to a tax-advantaged retirement savings account.

. Heres a breakdown of the different paycheck taxes and why they sometimes change. The income tax brackets have shifted with those making between 38701 and 82500 owing taxes of 445350 plus 22 percent of the amount over 38700. To do this simply file a new W-4 and write in the extra amount youd like withheld.

While taxes are a part of life you can play a role in how much comes out of your paycheck. The 24 percent tax bracket has those making between 82501 and 200000 paying 1408950 plus 24 percent. Contributions to these plans are considered pre-tax and are therefore exempt from federal income tax during the year in which you make the contribution.

Federal Tax Withholding Fed Tax FT or FWT Your employer will use information you provided on your new Form W-4 as well as the amount of your taxable income and how frequently you are paid in order to determine how much federal income tax withholding FITW to withhold from each. It might seem like youre going to be getting smaller paychecks but youre simply paying the taxes you owe in advance so you wont be surprised with a large tax bill later. Its important to point out that even if you are a W-2 employee you may still need to.

If you have too little tax withheld youll end up having to send the IRS a check when you file. For example say you. Eligible plan types include traditional IRAs and 401ks.

And Social Security taxes are. If you have too much tax taken out of your paycheck you will receive a refund but in the meantime youre giving the government an interest-free loan. Due to the Tax Cuts and Jobs Act you may see a change in the taxes coming out of your paycheck.

However those that are self-employed or earn income as an independent contractor have to make quarterly estimated tax payments on a quarterly basis aka 4 times a year. However you only pay half of this amount or 62 out of your paycheck -- the other half is paid by your employer. How You Can Affect Your Oregon Paycheck.

Pre-tax contributions change how. One thing you can do is tweak your tax withholdings by asking your employer to withhold an additional dollar amount from your paychecks. W-2 income earners normally have the necessary amount taken from their paycheck on their behalf.

New Tax Law Take Home Pay Calculator For 75 000 Salary

Different Types Of Payroll Deductions Gusto

How Many Taxes Are Taken Out Of A 300 Paycheck Quora

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

W4 Form Tax Withholding For Irs And State Income Taxes

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Paycheck Calculator Online For Per Pay Period Create W 4

Free Online Paycheck Calculator Calculate Take Home Pay 2022